Introduction

The journey of wealth creation and business growth inevitably involves continuous interaction with the Income Tax Department. While compliance is paramount, disputes are an undeniable reality of the tax landscape. Receiving an adverse assessment order from an Assessing Officer (AO) can be stressful, but it is certainly not the end of the road. The Indian Income Tax Act, 1961, is robustly structured to ensure that no taxpayer grievance goes unheard, providing a clear, multi-tiered appellate mechanism.

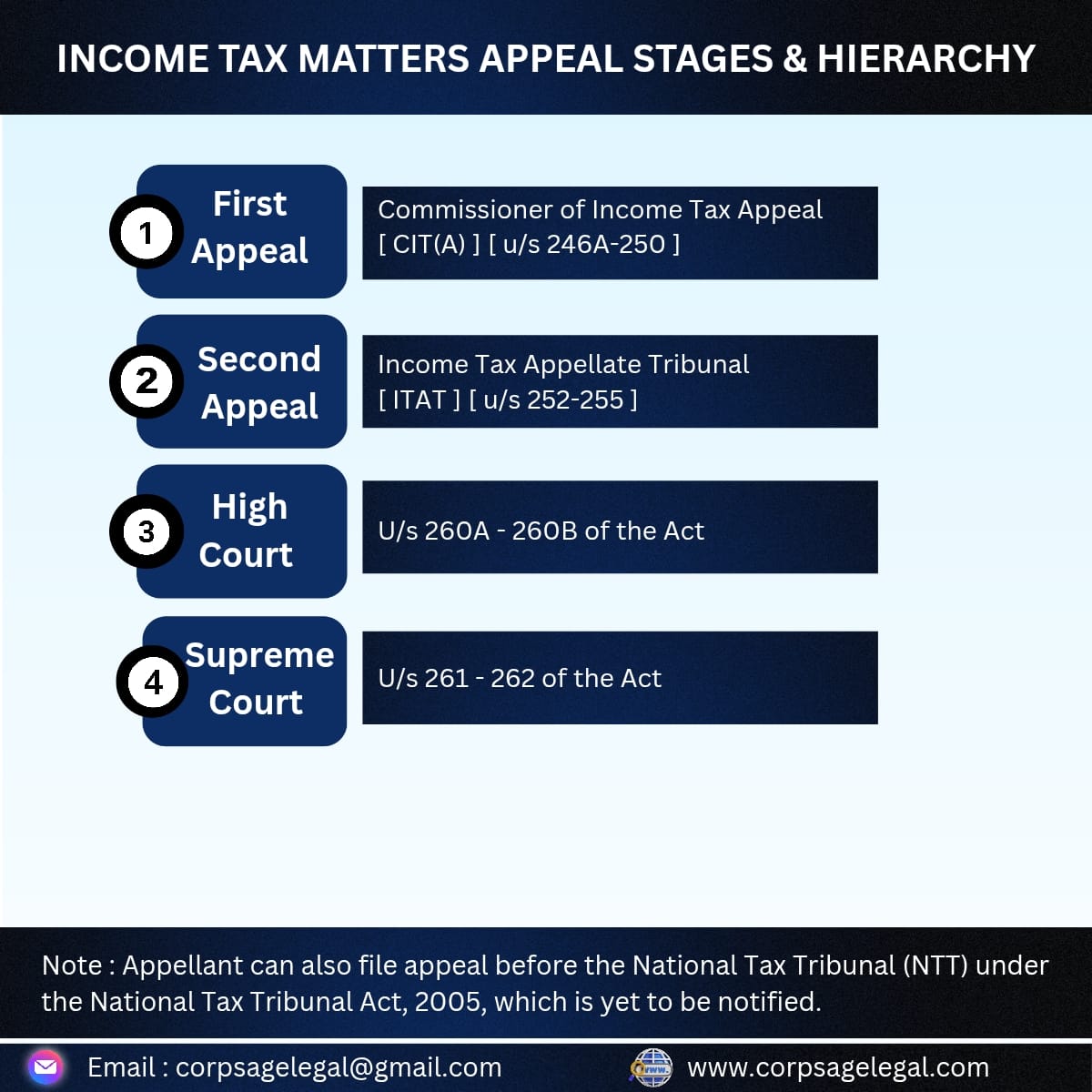

This comprehensive guide is designed to demystify the Income Tax Appeal Filing Procedure for companies and individuals alike. It is more than just a procedural checklist; it is a strategic roadmap to ensure your legitimate concerns are heard by higher authorities. The essential steps, from the first line of defence before the Commissioner of Income Tax (Appeals) to the final recourse at the Supreme Court, ensuring you approach the process with confidence and clarity.

Tier 1: The First Line of Defense : Appeal to the Commissioner of Income Tax (Appeals) [CIT(A)]

The Commissioner of Income Tax (Appeals) or CIT(A), is the first appellate authority available to an aggrieved taxpayer. Whether you are an individual assessee, a deductor, or a collector, if you are dissatisfied with certain orders passed by a lower authority, the CIT(A) is your initial port of call.

What Orders Can Be Challenged?

The scope of orders appealable before the CIT(A) is wide-ranging, covering crucial aspects of the assessment process. Key examples include:

1. Assessment Orders: Orders passed under Section 143(3) (regular assessment), Section 144 (best judgment assessment), or orders of re-assessment/re-computation under Section 147.

2. Intimations: Where a taxpayer objects to adjustments made in an intimation under Section 143(1) or related sections, like those under Section 200A (for TDS) or Section 206CB (for TCS).

3. Penalty Orders: Certain penalty orders passed by the Assessing Officer, unless the assessment order itself is not appealable.

4. Orders Reducing Refund/Enhancing Assessment: Orders passed under Section 154 or Section 155, which either enhance the assessment or reduce the refund payable.

5. Orders under Specific Sections: Orders related to TDS/TCS defaults (Section 201/206C) or orders concerning specific assessments (like those under Section 153A).

The Filing Procedure for CIT(A):

The procedure to file an appeal before the CIT(A) is initiated by filing Form 35 electronically on the Income Tax e-filing portal.

● Deadline: The appeal must generally be filed within 30 days from the date on which the order being challenged was received by the taxpayer. While the CIT(A) has the power to condone a delay, this power is exercised only if the taxpayer can prove a sufficient cause for the delay (e.g medical emergency, genuine system error). Timeliness is therefore non-negotiable.

● Fees: A mandatory fee must be paid, which depends on the total assessed income. The fee ranges from ₹250 to ₹1,000.

● Key Components of Form 35:

○ Grounds of Appeal: This is arguably the most critical section. It must clearly, concisely, and precisely state the legal and factual errors made by the Assessing Officer. Each ground should ideally be a self-contained legal argument.

○ Statement of Facts: This section provides a detailed, chronological narrative of the case facts, the proceedings before the AO and how the AO erred in law or fact. This statement is the factual backbone of your appeal.

○ Proof of Tax Payment: Evidence of the tax demanded by the AO (if any) that has been paid is often required, as payment of admitted tax or a portion of the disputed tax is generally a prerequisite to maintaining the appeal.

The Faceless Appeal Scheme and Natural Justice:

A significant modernization in the procedure is the introduction of the Faceless Appeal Scheme. This shifted the process online, largely eliminating physical hearings and ensuring anonymity between the appellant and the appellate authority. While this was initially challenged on grounds of natural justice, the amended scheme now provides the right to an online hearing, thus balancing efficiency with the principles of fair opportunity. Companies must ensure their representatives are adept at presenting their case and submissions through virtual channels, mastering the art of digital litigation.

Tier 2: The Final Fact-Finding Authority : Appeal to the Income Tax Appellate Tribunal (ITAT)

If the taxpayer is still aggrieved by the order of the CIT(A), the next recourse lies with the Income Tax Appellate Tribunal (ITAT). The ITAT is a quasi-judicial body and is the highest fact-finding authority under the Income Tax Act. Its decisions on facts are final and an appeal to a higher court is only possible on a substantial question of law.

The Filing Procedure for ITAT:

An appeal to the ITAT can be filed by either the assessee (taxpayer) or the Principal Commissioner/Commissioner (Department).

1. Form and Deadline:

○ The appeal is filed using Form 36.

○ The deadline for filing is generally 60 days from the date the CIT(A)’s order was communicated to the aggrieved party. Similar to the CIT(A), the ITAT can condone delays if a valid reason is presented, which is a matter of judicial discretion.

2. Appeal Fees: The filing fee for ITAT is based on the disputed income, ranging from ₹500 to ₹10,000. For cases where the total income assessed exceeds ₹10 lakh, the fee is ₹10,000.

3. Documents Required for Filing (The Paper Book): A successful appeal relies heavily on meticulous documentation. The following documents must be compiled into a ‘Paper Book,’ filed in duplicate, duly indexed and paged before the hearing date:

○ Form 36 (in triplicate).

○ Two copies of the CIT(A) order (including one certified copy).

○ Two copies of the original Assessment Order passed by the Assessing Officer.

○ Two copies of the ‘Grounds of Appeal’ and ‘Statement of Facts’ that were filed before the CIT(A).

○ If the appeal relates to a penalty, two copies of the relevant assessment order.

○ Copy of the challan for fee payment.

○ Any other relevant documentation used during assessment or first appeal.

Cross-Objections (Form 36A):

If the Income Tax Department files an appeal against the CIT(A)’s order, the assessee (who might be partially satisfied with the CIT(A)’s order but wants to challenge other points) can file ‘Cross-Objections’ using Form 36A. This must be done within 30 days of receiving notice of the Department’s appeal, ensuring both parties’ contentions are heard simultaneously by the ITAT.

Additional Evidence:

The ITAT typically focuses on the evidence already presented before the lower authorities. However, it can admit additional evidence that was not produced before the CIT(A), provided the appellant can show that they were prevented by sufficient cause from producing the evidence at the earlier stage. This rule emphasizes the importance of providing all relevant facts at the Assessment and CIT(A) stages.

Tier 3: Recourse on Question of Law : Appeal to the High Court

The appellate journey moves to the judiciary once the ITAT has pronounced its order. An appeal against the order of the ITAT lies before the respective jurisdictional High Court.

● The Substantial Question of Law: Crucially, an appeal to the High Court is only permissible if the High Court is satisfied that the case involves a substantial question of law. It is not a forum for revisiting the facts determined by the ITAT. Examples of substantial questions of law include misinterpretation of a statutory provision, failure to apply a legal principle correctly, or a perverse finding of fact (a finding that is not supported by any evidence or is based on speculation).

● Procedure and Timeline: The appeal is filed in the form of a memorandum outlining the substantial question of law. It must be filed within 120 days from the date the ITAT’s order was received. The appeal bench typically consists of a minimum of two High Court Judges, and the hearing is confined to the questions of law formulated by the court.

Tier 4: The Apex Court : Appeal to the Supreme Court

The final court of appeal for any income tax matter is the Supreme Court of India. An appeal can be made to the Apex Court from the High Court in the following circumstances:

1. If the High Court certifies that the case is fit for appeal to the Supreme Court.

2. Against a judgment of the High Court on a reference made under earlier provisions of the Income Tax Act.

The Supreme Court acts as the final judicial arbiter, setting precedents that are binding across the country, resolving the most complex and constitutionally significant legal dilemmas in tax jurisprudence.

Strategic Considerations for Successful Tax Appeal Litigation

Filing an appeal is a legal procedure but a successful outcome requires a strategic approach:

● Documentation Integrity: Maintain meticulous, indexed, and cross-referenced records. The ‘Paper Book’ is the foundation of your case, and any missing link can prove detrimental.

● Clarity of Grounds: Draft clear, precise, and legally sound Grounds of Appeal. The court’s focus is defined by these grounds, and ambiguity can severely prejudice your case.

● Understanding Faceless Proceedings: Even with the right to a physical hearing, mastering virtual communication and submission methods is vital for modern tax litigation.

● Professional Expertise: Given the complexity of the procedures, legal interpretation, and the nuances of the Income Tax Act, engaging experienced Income Tax Consultants or Tax Litigation Lawyers is indispensable. Their expertise can ensure compliance with all procedural deadlines and the formulation of winning legal arguments.

Conclusion

The Income Tax Appeal filing procedure is a systematic, structured avenue for taxpayers to challenge decisions that they deem incorrect or unjustified. From the detailed procedural requirements of Form 35 before the CIT(A) and Form 36 before the ITAT, to the elevated legal scrutiny at the High Court and Supreme Court, the system provides sufficient opportunity for redressal.

The key to a successful appeal lies in preparation, adherence to strict deadlines and clear presentation of facts supported by law. Don’t let an adverse order define your tax position use the established appellate mechanism to secure accurate and fair justice. By leveraging professional guidance and respecting the procedural steps outlined above, companies and individuals can effectively navigate this crucial process, ensuring their compliance and legal rights are protected.

To connect with us for contract management services for your business, follow any of the below-mentioned ways:

Fill up the following form

Fill up the following form with your query & questions, and we shall send you a detailed email response within 24 hours.

At Corpsage Legal LLP, we provide all-inclusive Legal Process Management Services to companies. Herein, we become their sole contact for all the legal requirements related to their business.

© 2025 CorpSageLegal. All rights reserved.

© 2025 CorpSageLegal. All rights reserved.

ACKNOWLEDGEMENT

The rules of the Bar Council of India prohibit lawyers and law firms from soliciting work and advertising. By proceeding further and clicking on the “I AGREE” button herein below, I hereby acknowledge that I, of my own accord, intend to know more and subsequently acquire more information about CORPSAGE for my own purpose and use. I further acknowledge that there has been no advertisement, solicitation, communication, invitation or inducement of any sort whatsoever from CORPSAGE or any of its members to create or solicit an attorney-client relationship through this website. I further acknowledge having read and understood and perused through the content of the DISCLAIMER mentioned below and the Privacy Policy.

DISCLAIMER

This website (www.corpsagelegal.com) is a resource for informational purposes only and is intended, but not promised or guaranteed, to be correct and complete. CORPSAGE does not warrant that the information contained on this website is accurate or complete, and hereby disclaims any and all liability to any person for any loss or damage caused by errors or omissions, whether such errors or omissions result from negligence, accident or any other cause. Any information obtained or downloaded from this website is completely at the user’s volition and their own discretion and any further transmission, receipt or use of this website would not create any attorney-client relationship. The contents of this website do not constitute, and shall not be construed as, legal advice or a substitute for legal advice. All material and information (except any statutory enactments and/ or judicial precedents) on this website is the property of CORPSAGE and no part thereof shall be used, without the express prior written consent of CORPSAGE.

AGREE DISAGREE

You cannot copy content of this page